UX CASE STUDY

UX CASE STUDY

SAVING APP

SAVING APP

2022

2022

Savings and Budgeting Solution

Savings and Budgeting Solution

Savings and Budgeting Solution

for University Students

for University Students

for University Students

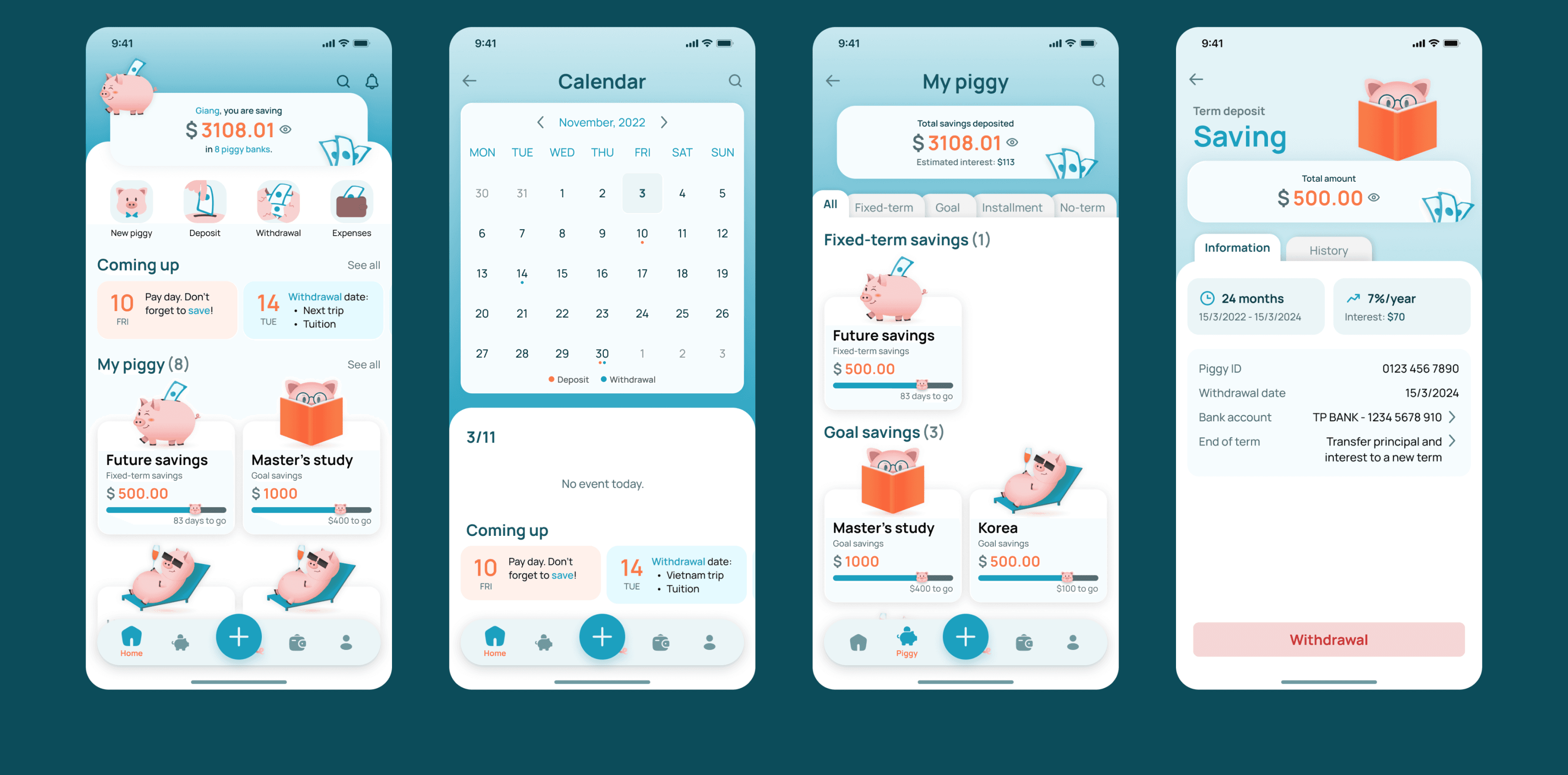

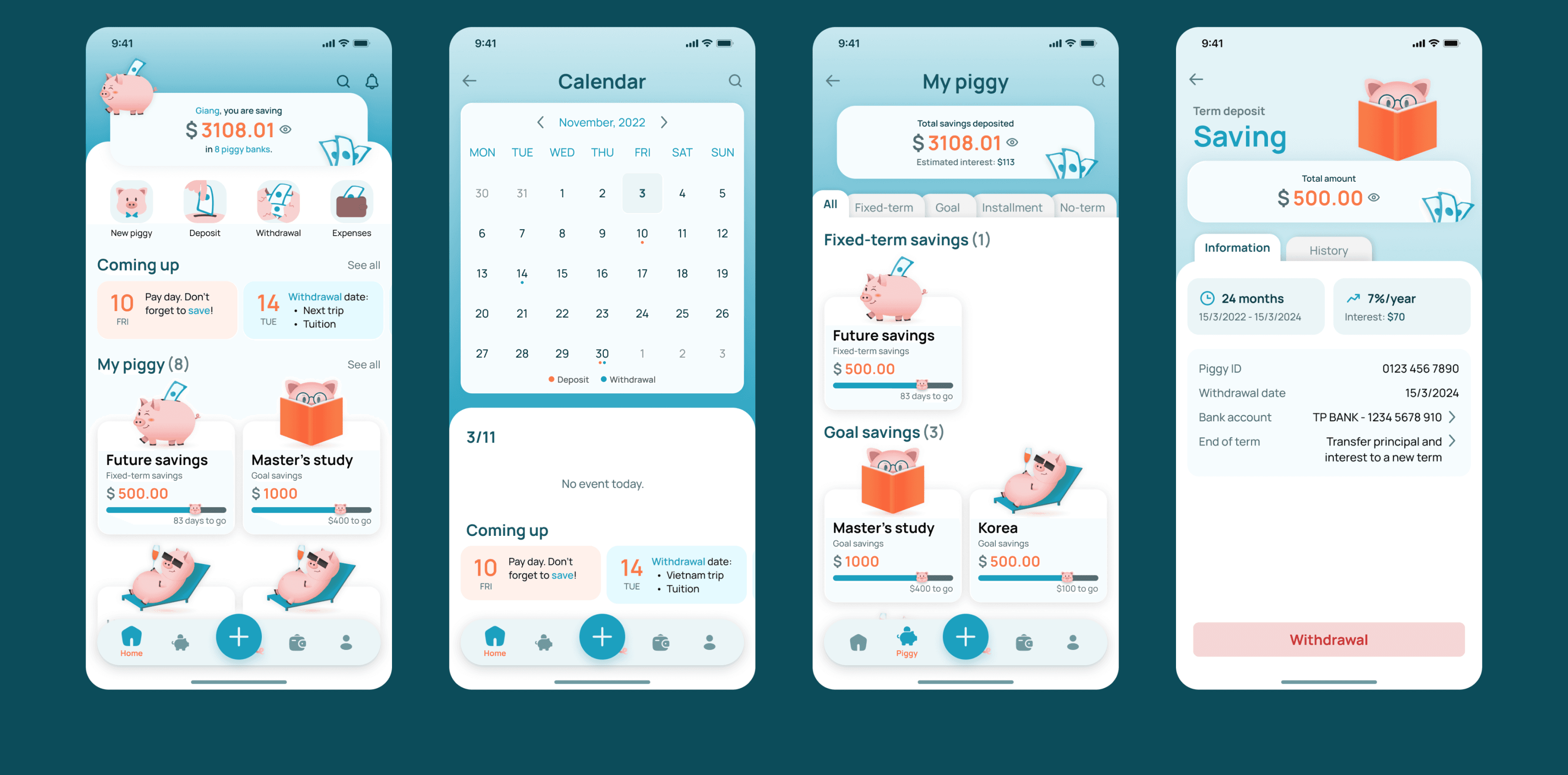

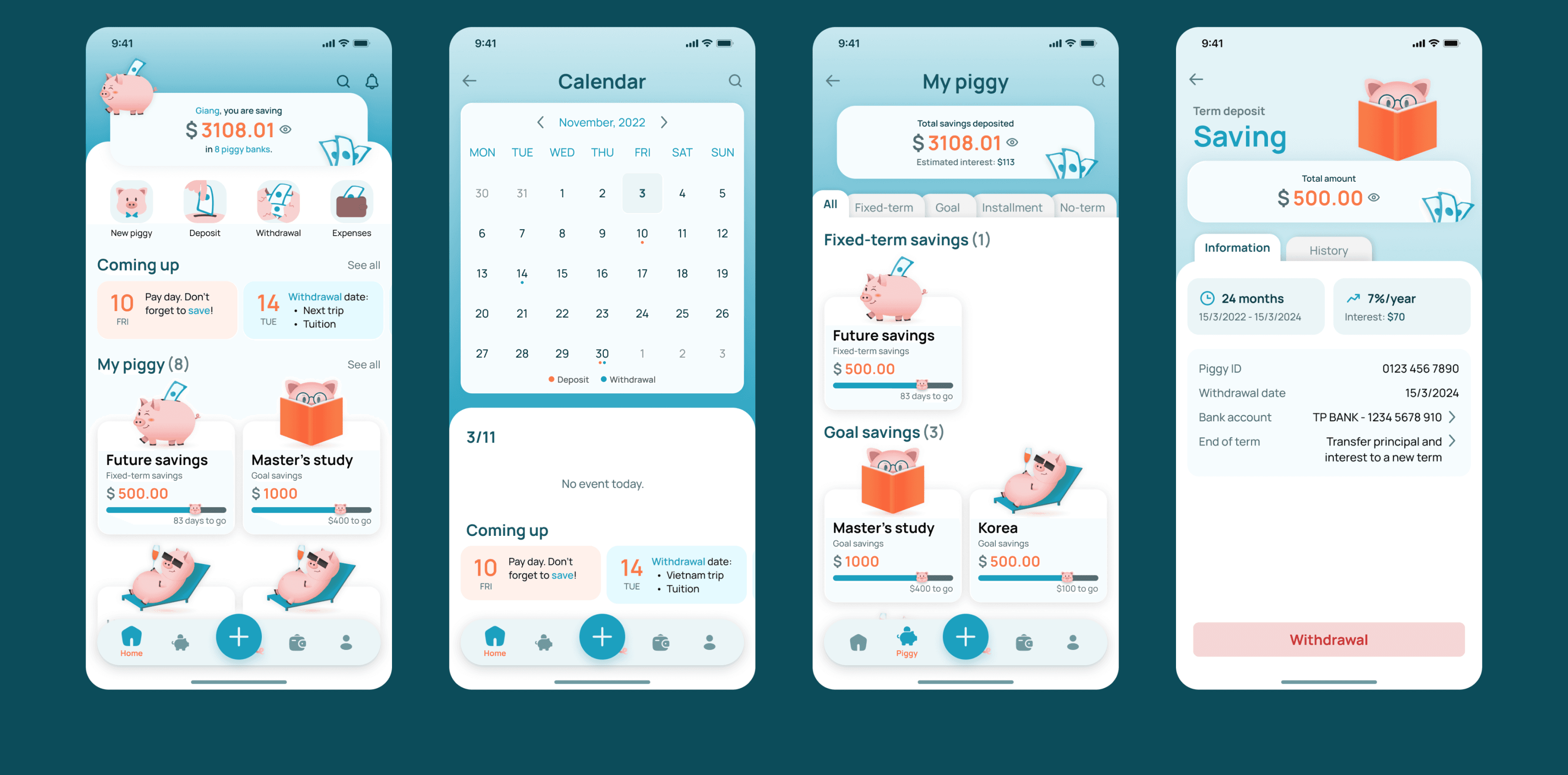

ONG HEO is a savings application designed to help students start saving for their future.

ONG HEO is a savings application designed to help students start saving for their future.

ONG HEO is a savings application designed to help students start saving for their future.

SPECS

SPECS

1 member (me!)

Instructor: Regina Nguyen

2 months duration

1 member (me!)

Instructor: Regina Nguyen

2 months duration

WHAT WAS DONE

WHAT WAS DONE

UX/UI design

Research

Illustrations

UX/UI design

Research

Illustrations

TOOLS USED

TOOLS USED

Figma

Google Forms

Adobe Illustrator

Figma

Google Forms

Adobe Illustrator

background

background

background

Living expenses are rising across Vietnam, with big cities—where most universities are located—experiencing the most significant increases, resulting in greater financial challenges for college students. While most still receive family support and do part-time jobs, the high cost of living makes smart spending essential.

Living expenses are rising across Vietnam, with big cities—where most universities are located—experiencing the most significant increases, resulting in greater financial challenges for college students. While most still receive family support and do part-time jobs, the high cost of living makes smart spending essential.

Living expenses are rising across Vietnam, with big cities—where most universities are located—experiencing the most significant increases, resulting in greater financial challenges for college students. While most still receive family support and do part-time jobs, the high cost of living makes smart spending essential.

DISCOVER

DISCOVER

DISCOVER

METHODS

Desk research

In-depth interviews

Competitor analysis

Desk research

In-depth interviews

Competitor analysis

Desk research

In-depth interviews

Competitor analysis

8 interviewees

6 competitors

8 interviewees

6 competitors

8 interviewees

6 competitors

TARGET USER

Undergrad students (19 - 23 years old)

Limited finances and unstable income

Live independently in expensive cities

Undergrad students (19 - 23 years old)

Limited finances and unstable income

Live independently in expensive cities

Undergrad students (19 - 23 years old)

Limited finances and unstable income

Live independently in expensive cities

GOALS

Understand student insights and pain points when managing daily expenses.

Explore students' past and current saving methods and evaluate their effectiveness.

Understand student insights and pain points when managing daily expenses.

Explore students' past and current saving methods and evaluate their effectiveness.

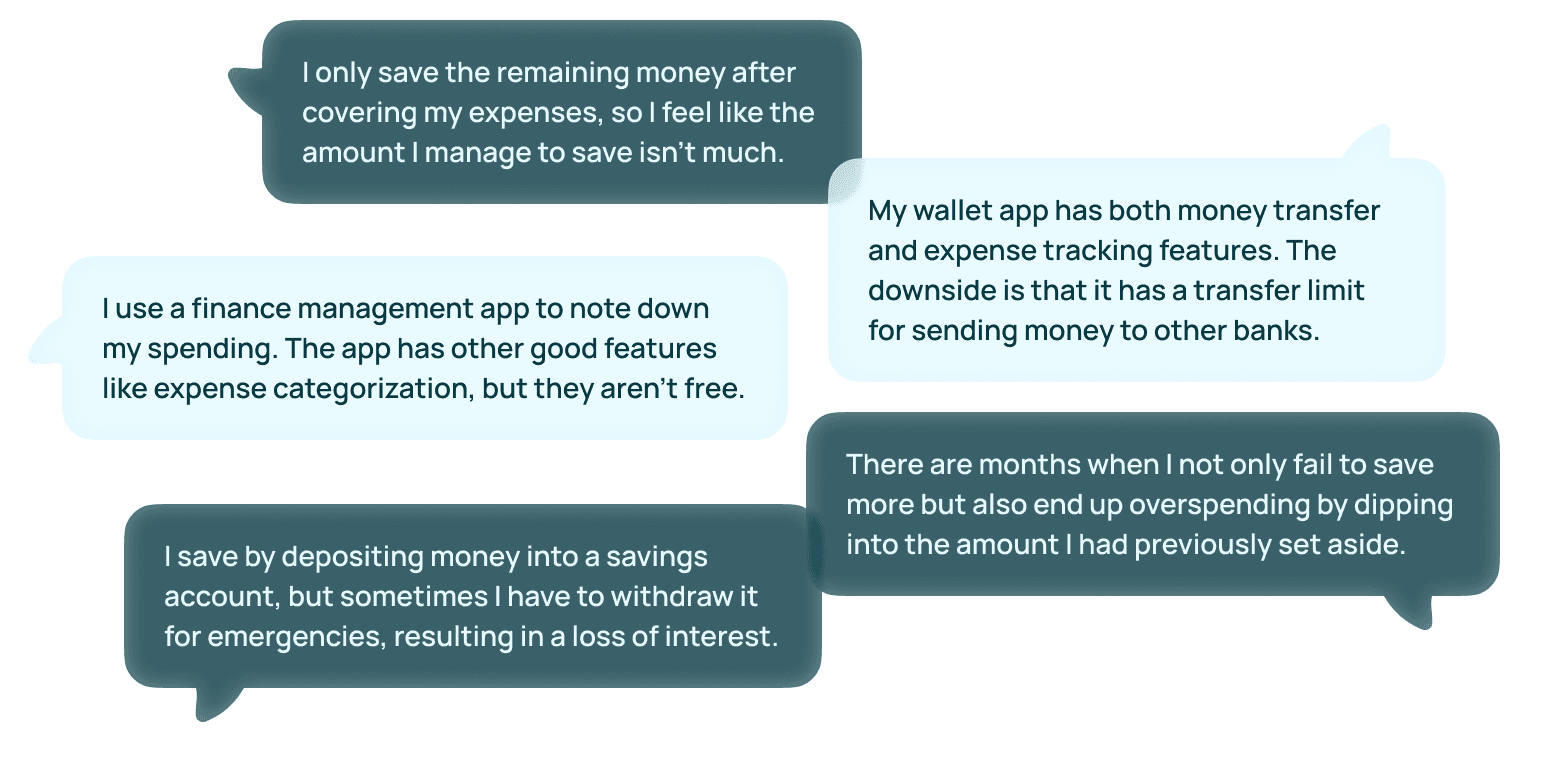

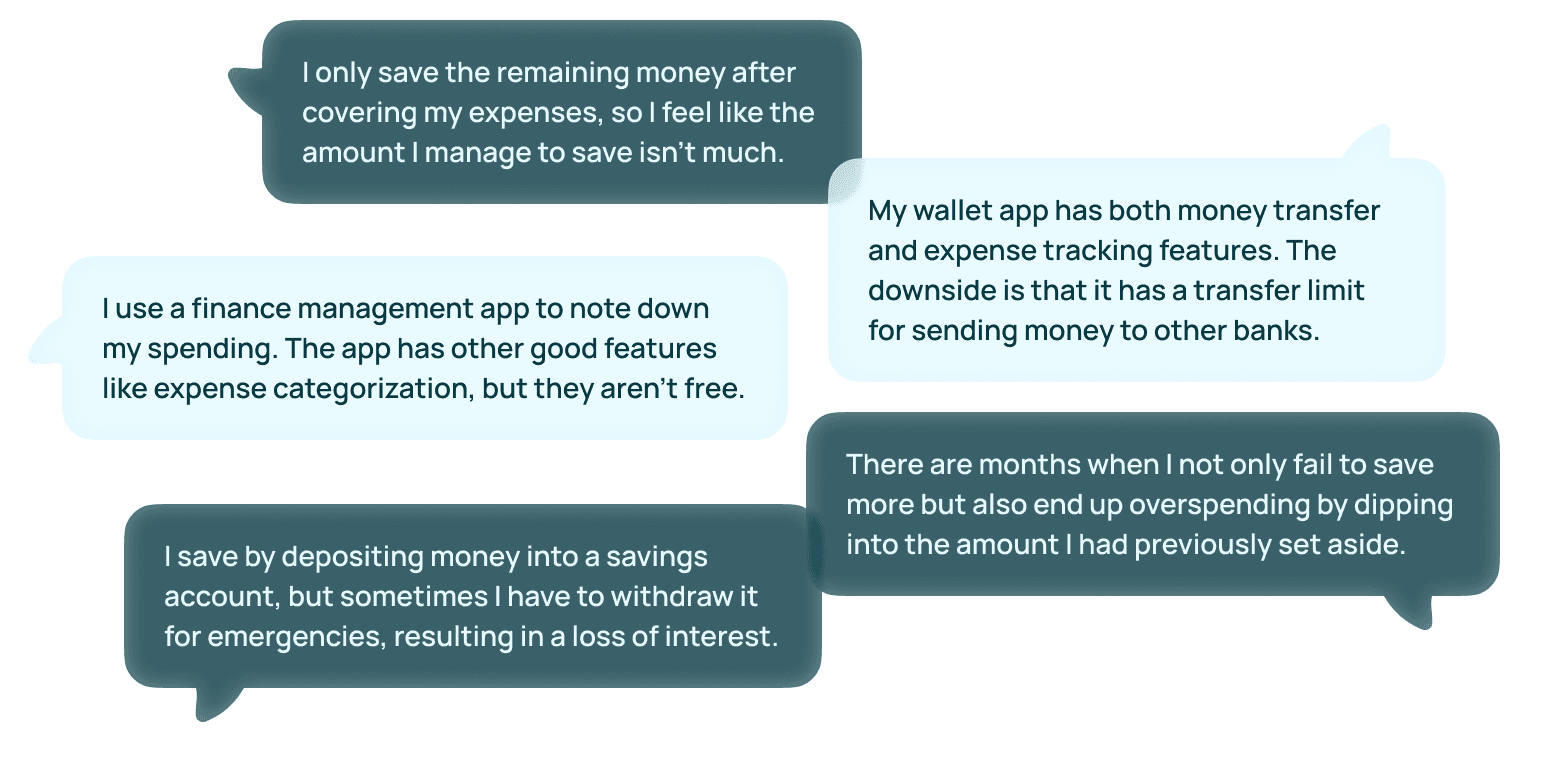

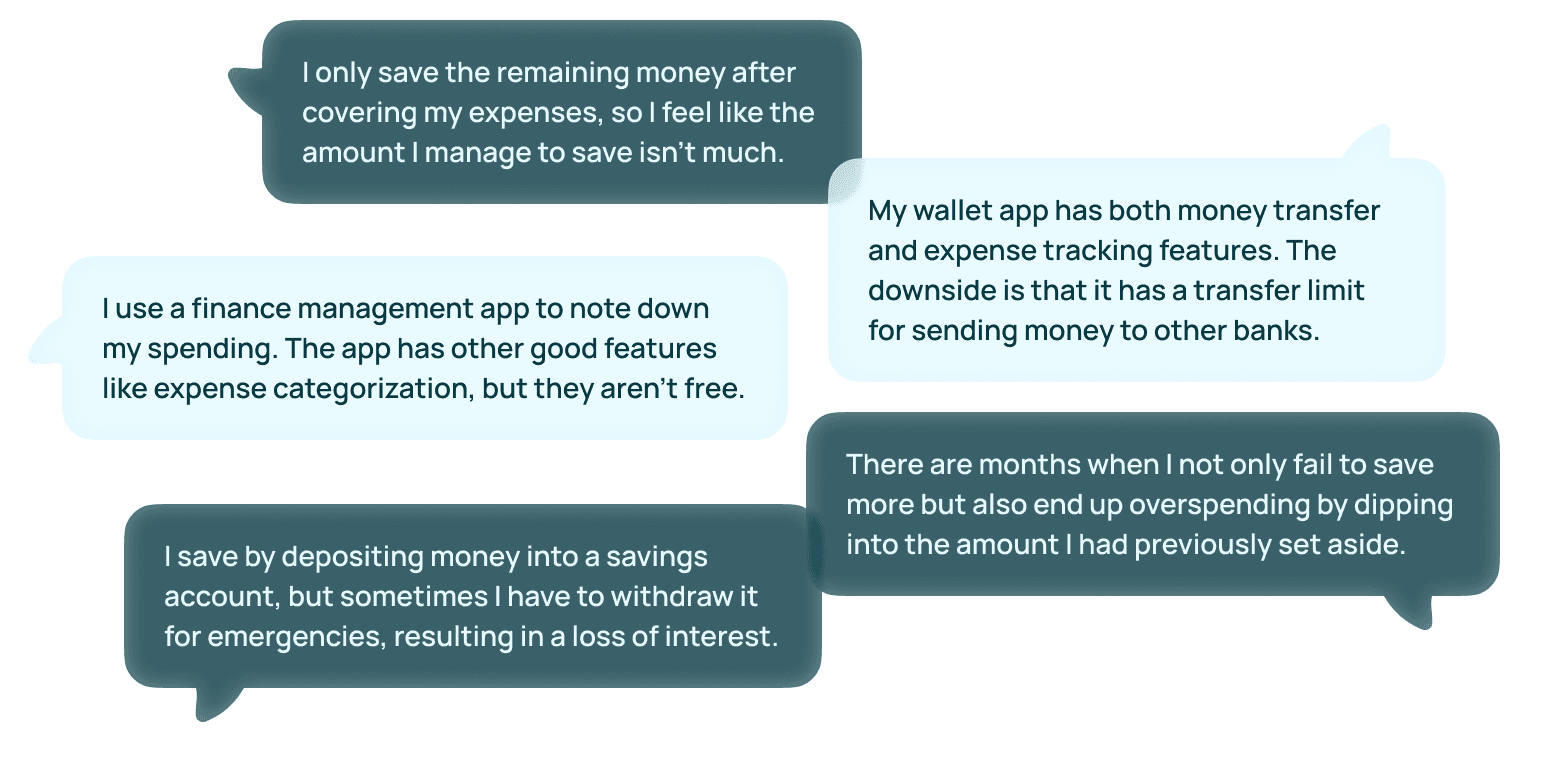

Interview results

Interview results

Interview results

Savings Purpose

Savings Purpose

Savings Purpose

Save for a current goal

Save for a current goal

Save for a current goal

Save for the future

Save for the future

Save for the future

Saving Methods

Saving Methods

Saving Methods

Save the remaining money

Save the remaining money

Save the remaining money

Cut back on expenses when needed

Cut back on expenses when needed

Cut back on expenses when needed

Distribute money into spending and savings categories beforehand

Distribute money into spending and savings categories beforehand

Distribute money into spending and savings categories beforehand

Common Challenges

Common Challenges

Common Challenges

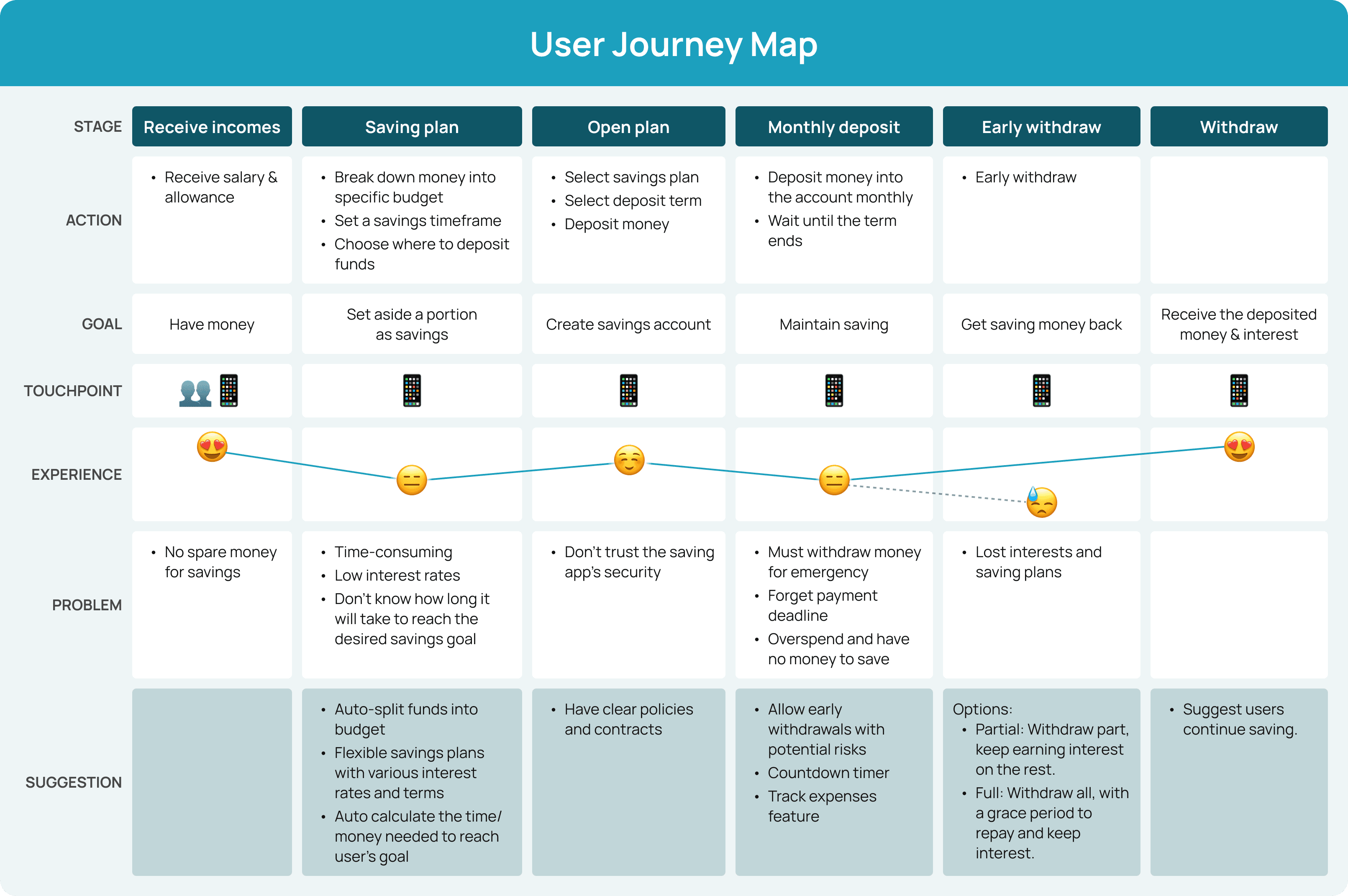

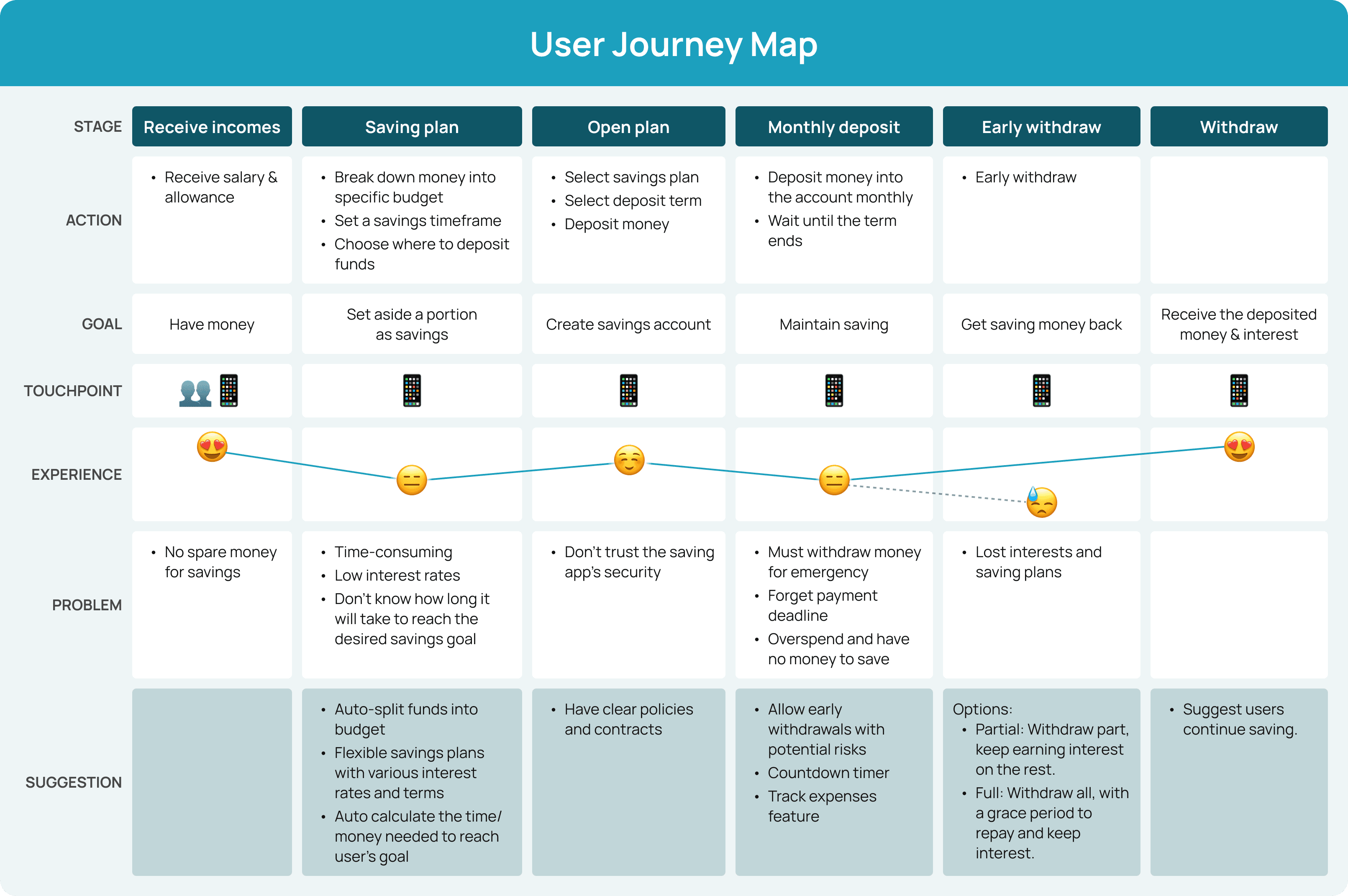

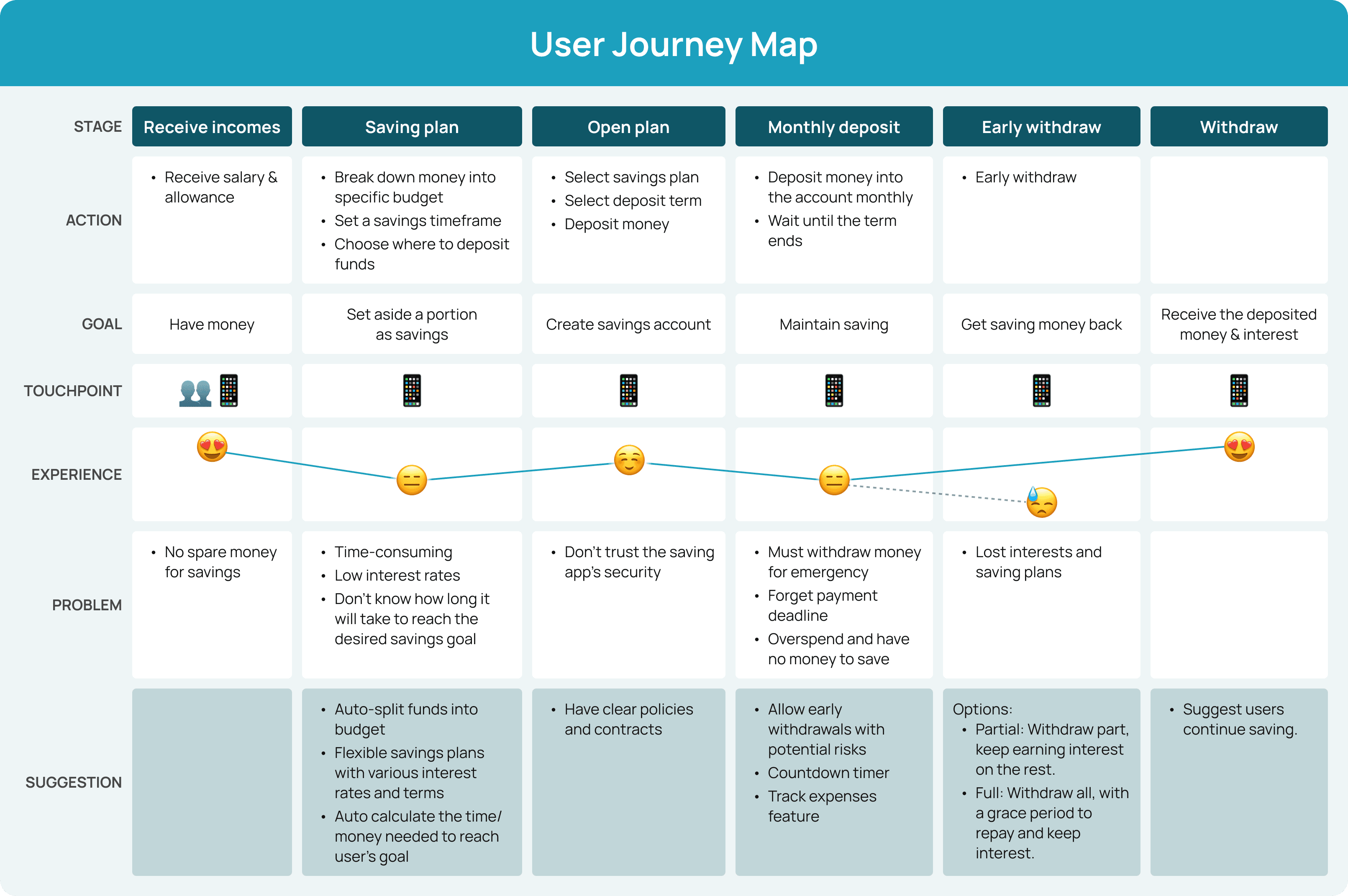

DEFINE USER Persona & Journey map

DEFINE USER Persona & Journey map

DEFINE USER Persona & Journey map

Solutions

Solutions

Solutions

PROBLEM #1

PROBLEM #1

Emergency withdrawals lead to loss of interest or use up savings

Emergency withdrawals lead to loss of interest or use up savings

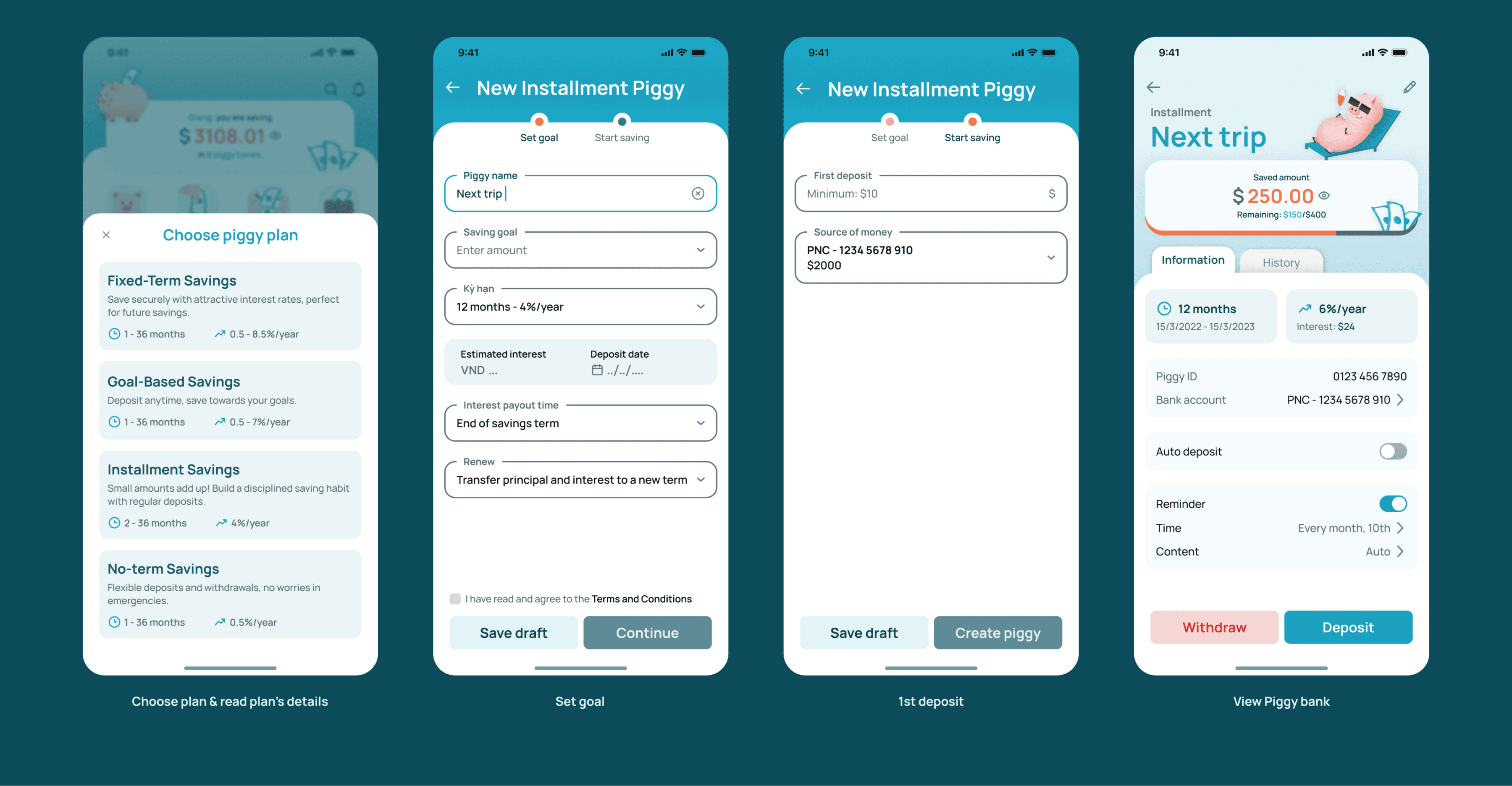

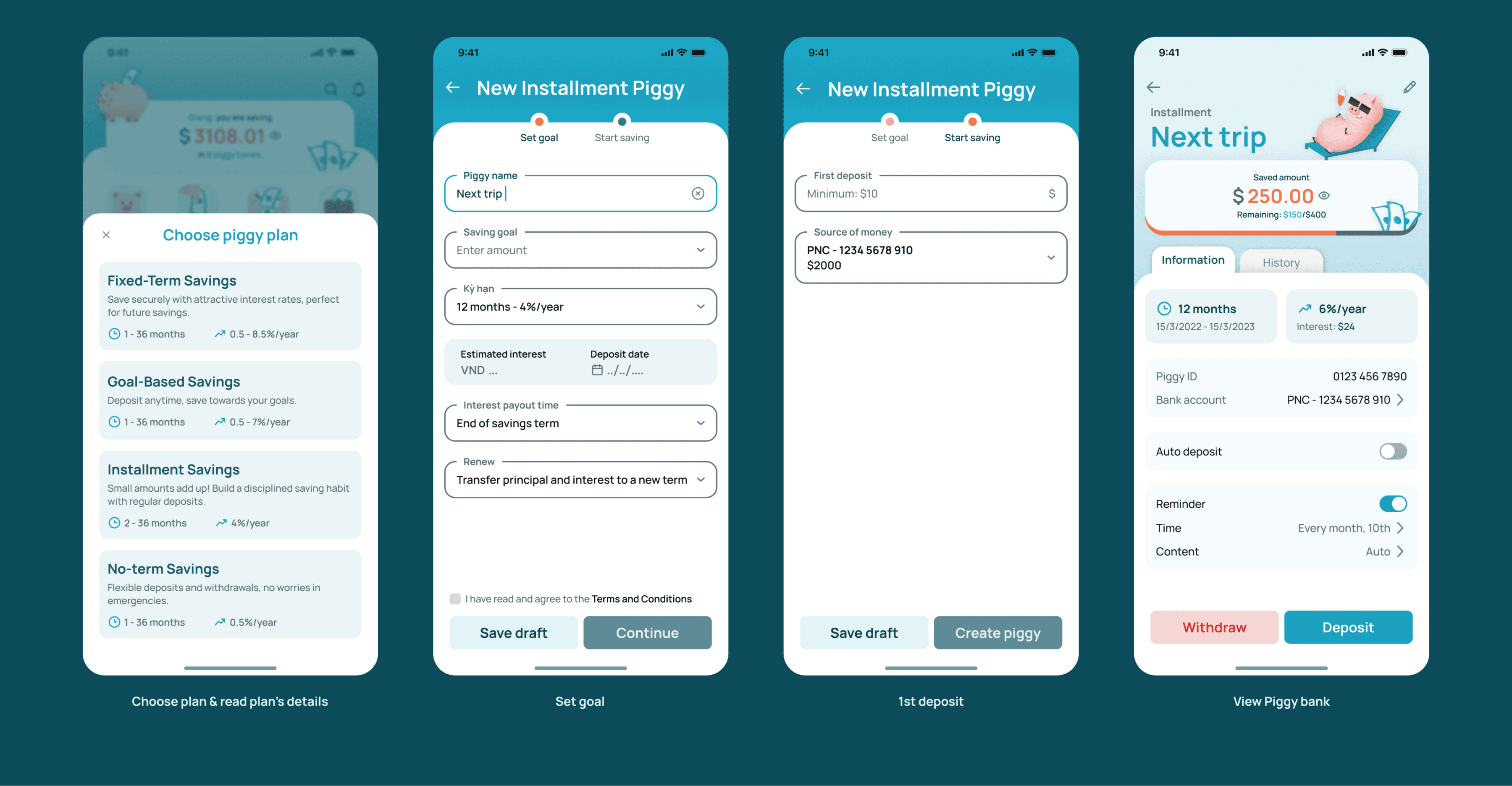

Encourage users separating saving into smaller funds (for future, for specific goals, for emergency) and provide different types of savings plan:

Fixed-Term – Locked-in deposits with higher interests

Goal-Based – Targeted saving for specific goals

Installment – Regular deposits, ideal for disciplined saving

No-term – Withdraw anytime with with lower interest, ideal for emergencies.

Encourage users separating saving into smaller funds (for future, for specific goals, for emergency) and provide different types of savings plan:

Fixed-Term – Locked-in deposits with higher interests

Goal-Based – Targeted saving for specific goals

Installment – Regular deposits, ideal for disciplined saving

No-term – Withdraw anytime with with lower interest, ideal for emergencies.

PROBLEM #2

Overspend and difficulty tracking expenses

Problem #3

Find budgeting complicated

Let user create budgeting plan and note down expenses by categories. Provide personalized daily, weekly, monthly, yearly spending overview.

Auto-budgeting:

Allow users select or add budget

Allow users locked fixed budget (e.g., rent) and distribute the remaining funds automatically.

Allow users to set custom split ratios for budgets.

Let user create budgeting plan and note down expenses by categories. Provide personalized daily, weekly, monthly, yearly spending overview.

Auto-budgeting:

Allow users select or add budget

Allow users locked fixed budget (e.g., rent) and distribute the remaining funds automatically.

Allow users to set custom split ratios for budgets.

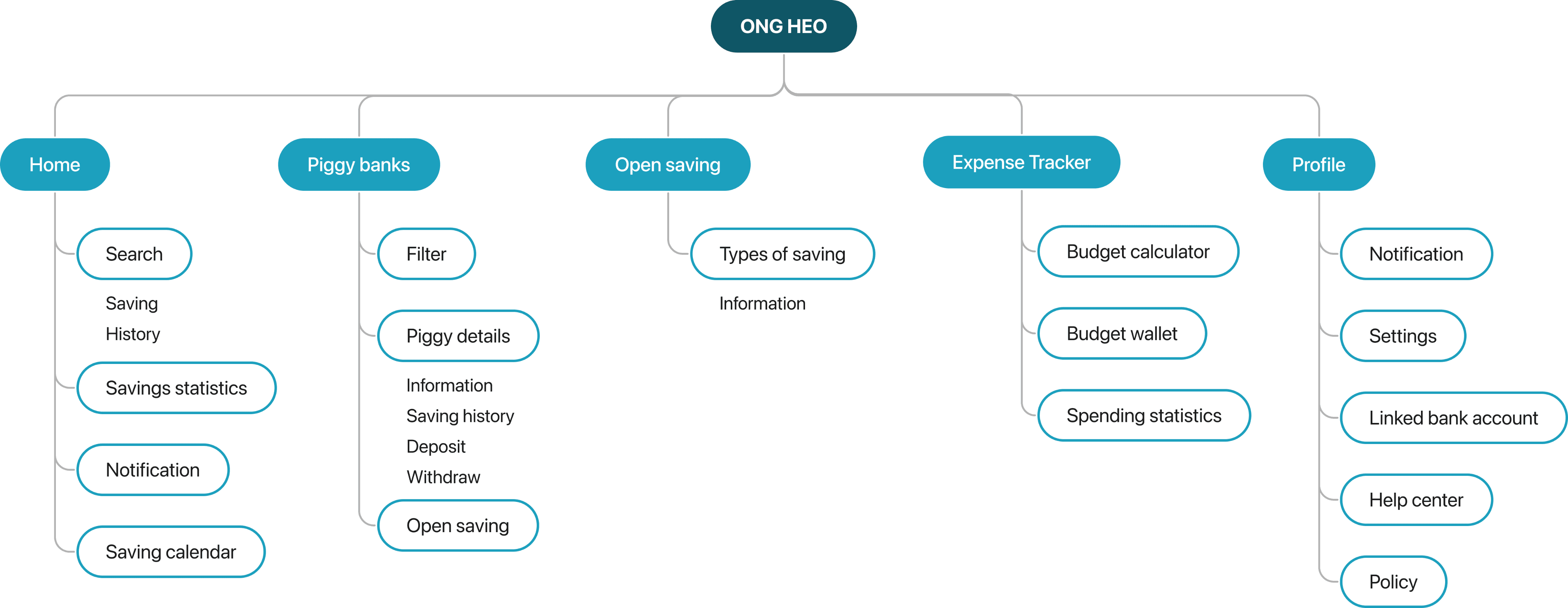

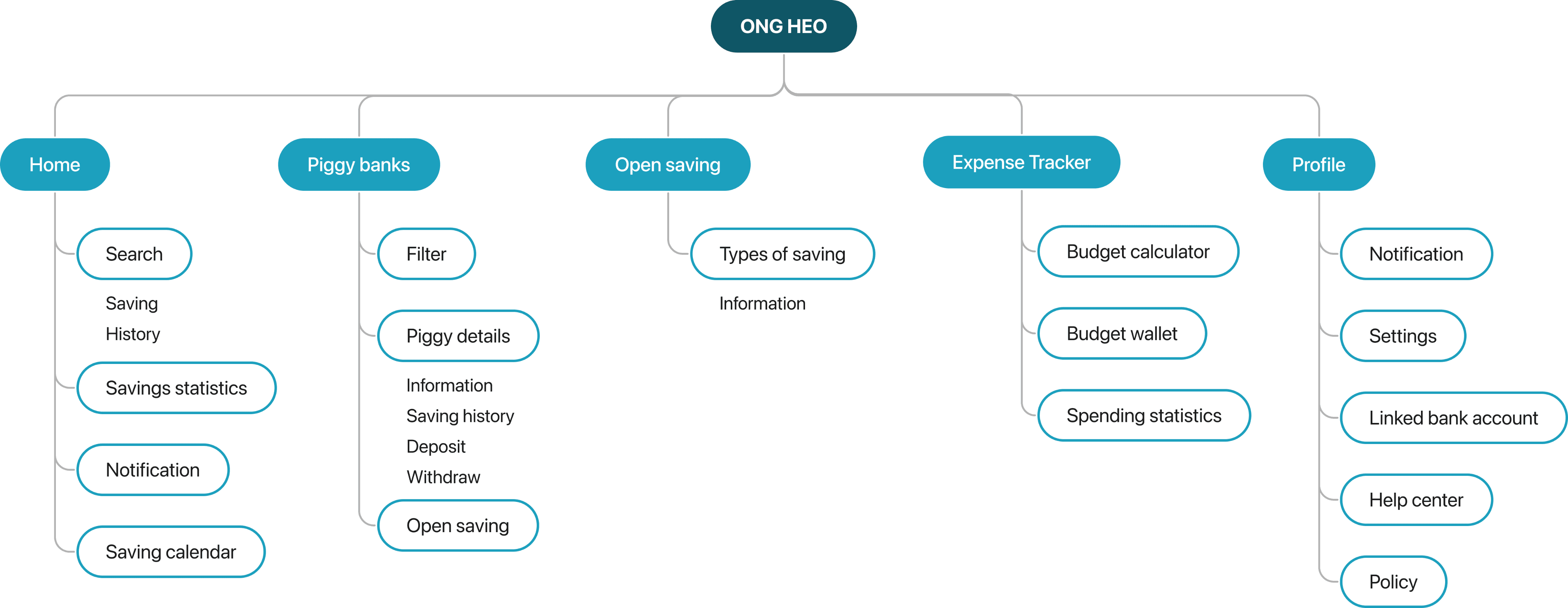

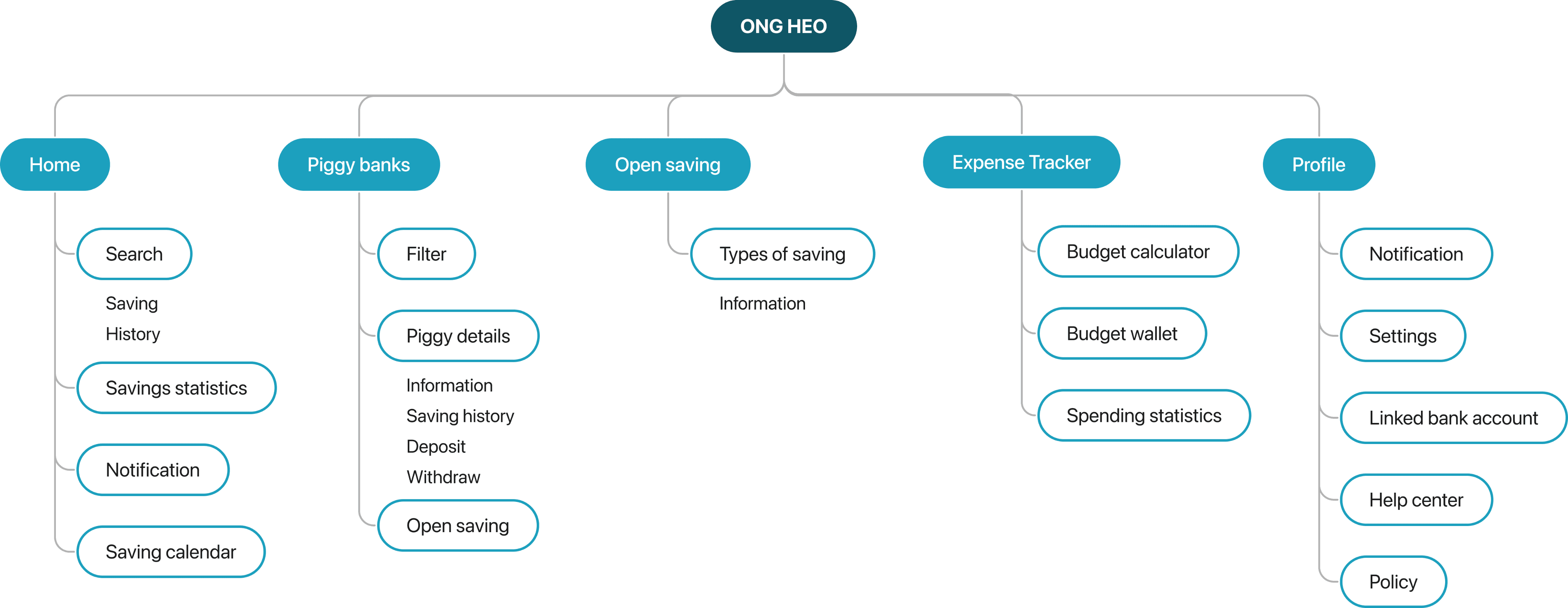

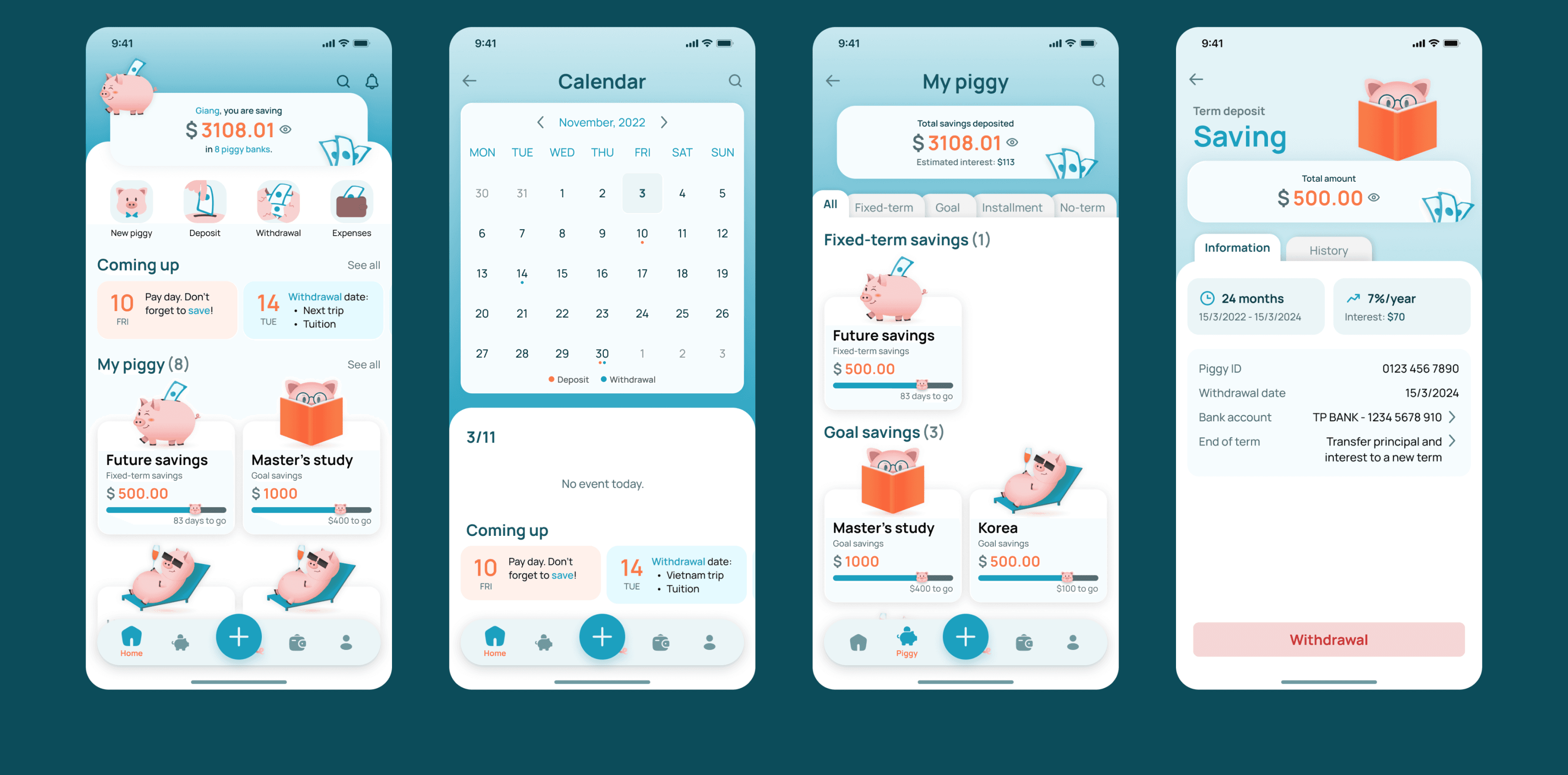

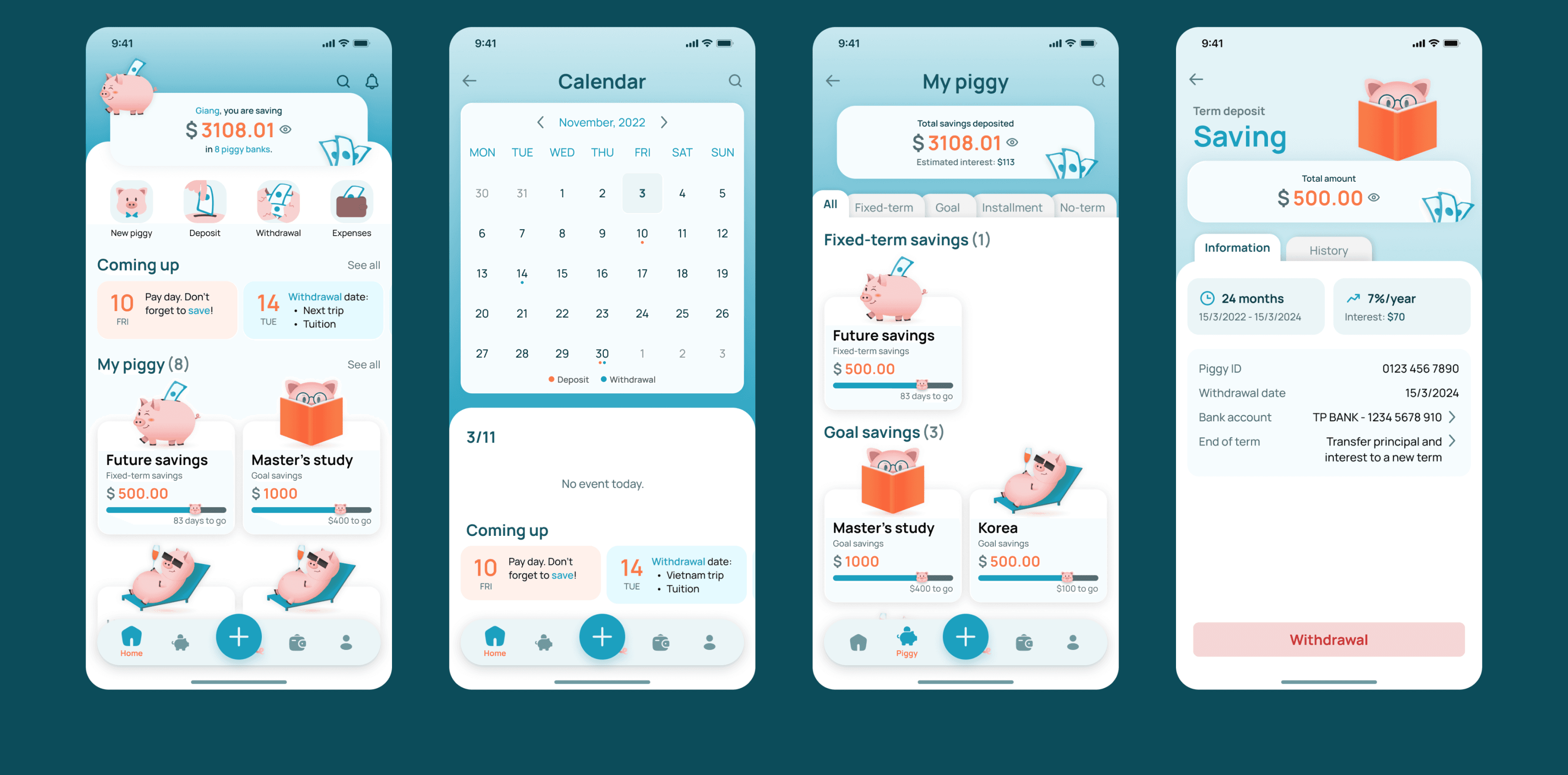

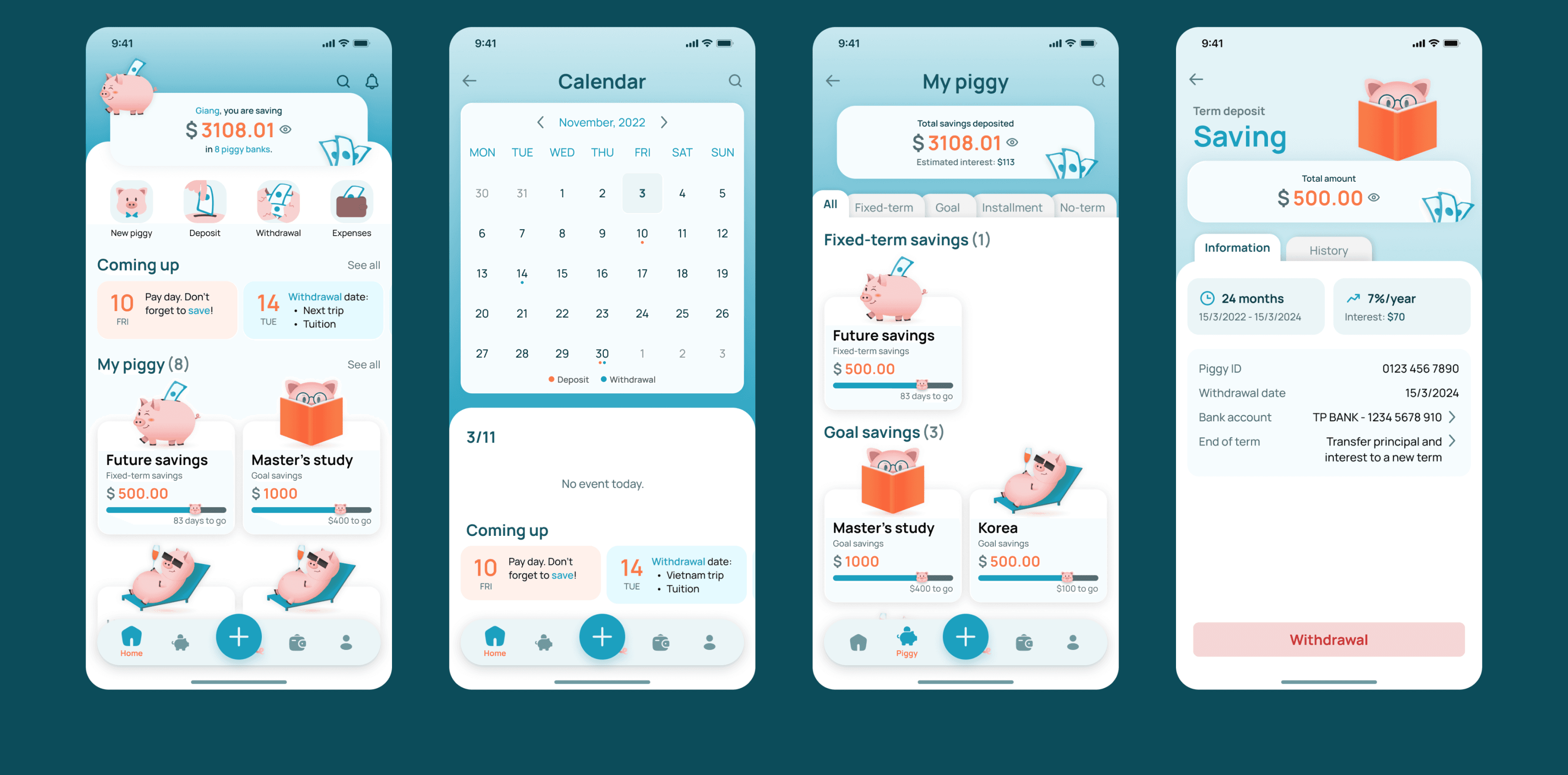

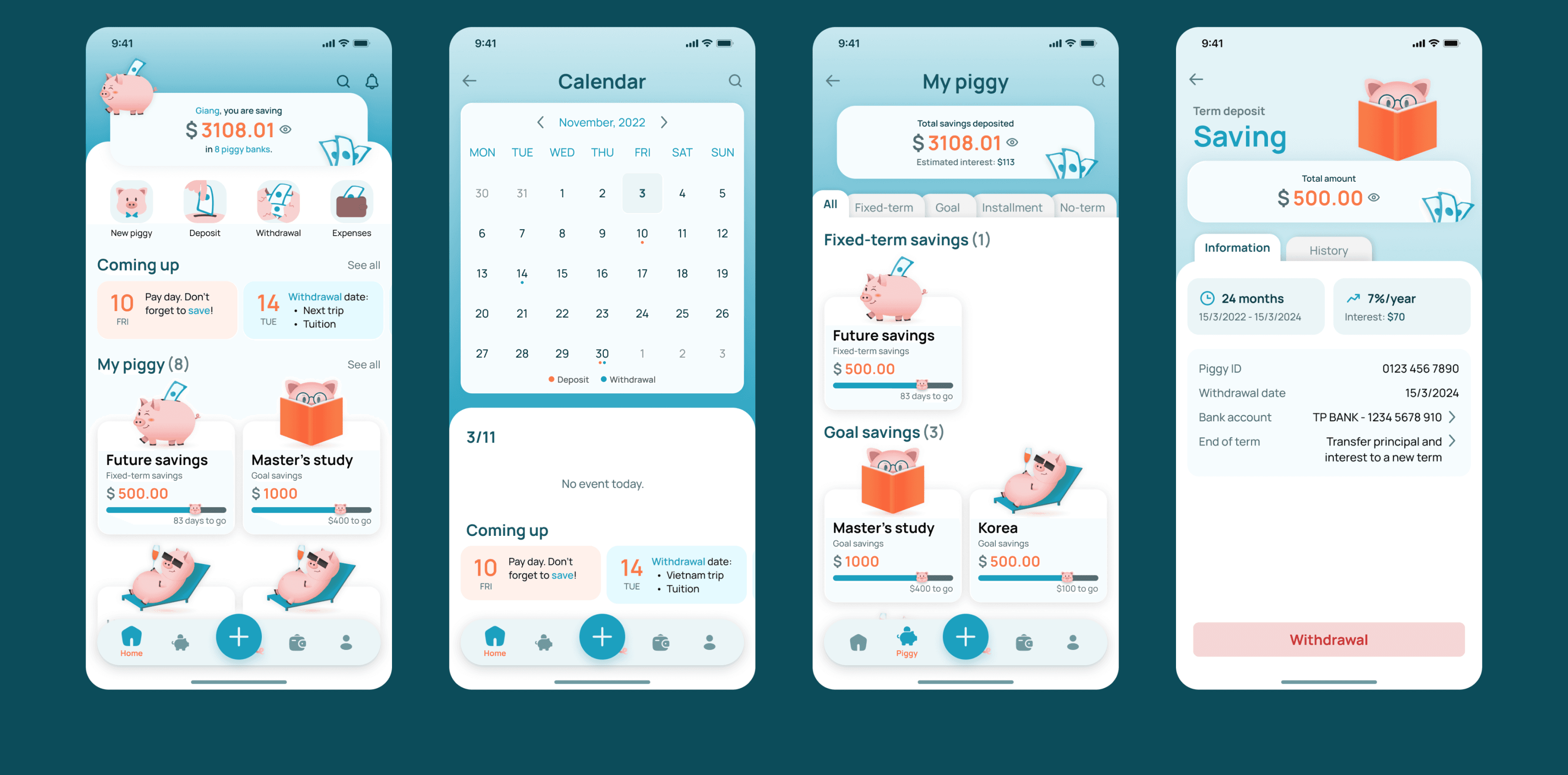

RESULTS

RESULTS

RESULTS

Design Concept

Design Concept

Design Concept

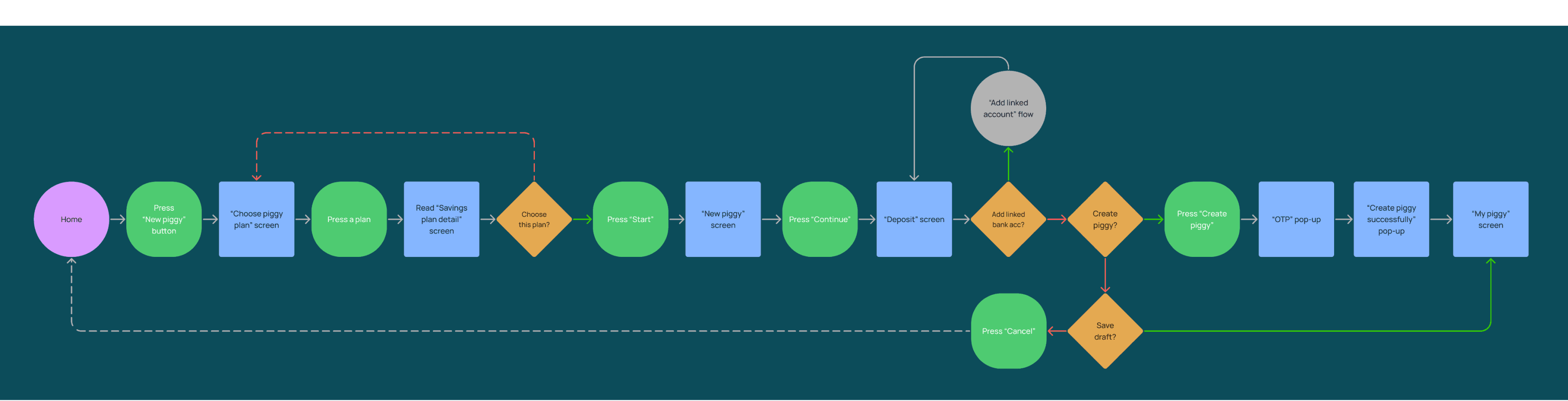

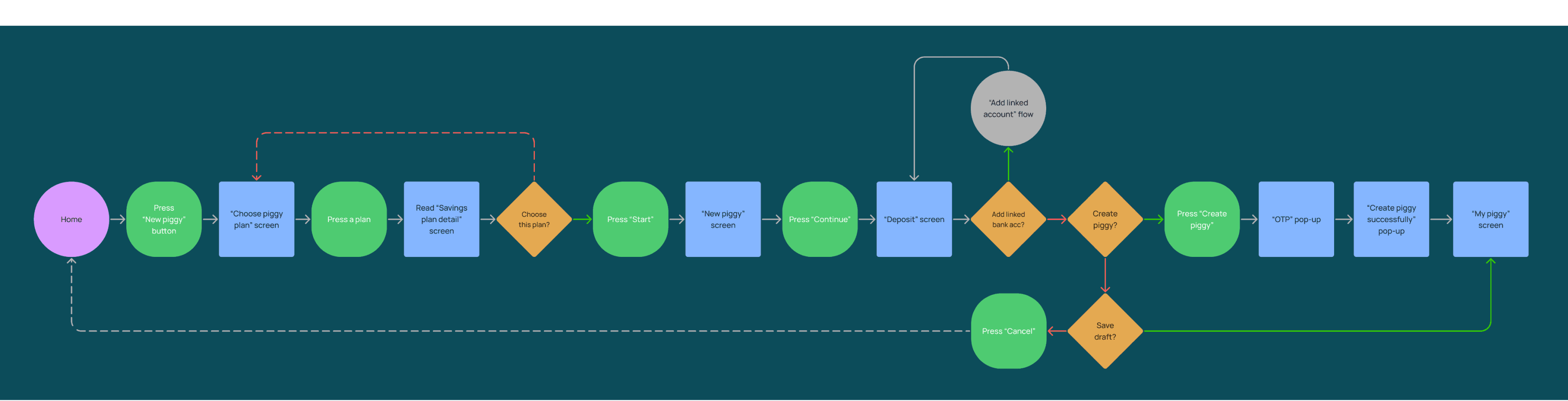

Flow: Create new piggy

Flow: Create new piggy

Flow: Create new piggy

Flow: Budget planning

Flow: Budget planning

Flow: Budget planning

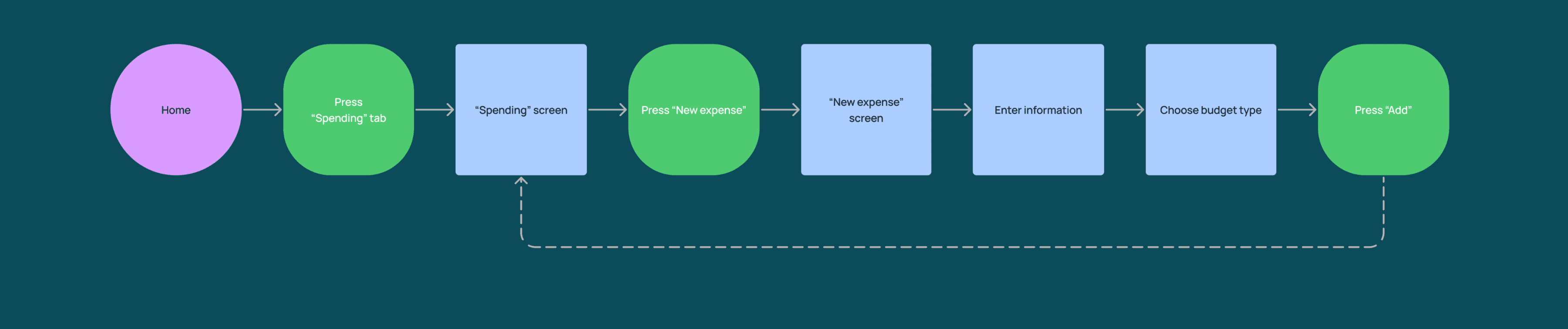

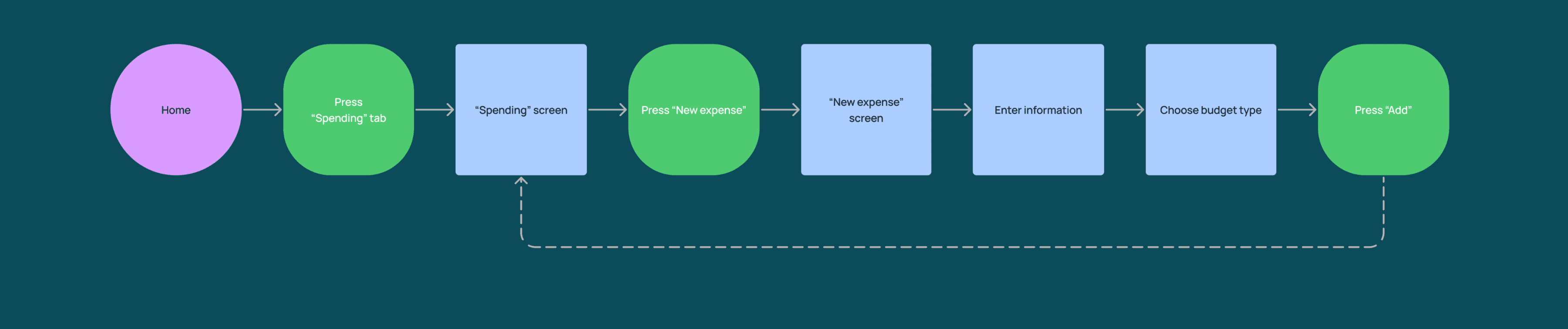

Flow: Add expenses

Flow: Add expenses

Flow: Add expenses

Have a challenge?

Let’s solve it together!

© 2025 Giang Dinh. All rights reserved.

Have a challenge?

Let’s solve it together!

© 2025 Giang Dinh. All rights reserved.

Have a challenge?

Let’s solve it together!

© 2025 Giang Dinh. All rights reserved.